Key Takeaways:

(Overview): Beginners should treat scalping as a long-term learning journey rather than something to master quickly.

(Basics of markets): Master how NSE, BSE, MCX and currency derivatives work, including lot sizes, margin requirements and trading costs.

(Platform): Learn your trading platform thoroughly so you can use fast order entry, bracket orders and hotkeys confidently in a demo environment.

(Backtest): Backtest and replay your scalping rules on historical NIFTY, BANK NIFTY and USD INR charts bar by bar.

(Demo trading): Demo-trade intensively for several weeks to practise your scalping plan and build discipline without risking money.

(Small live start): When you go live, keep position size and risk very small until you have a statistically meaningful sample of trades.

(Journal): Maintain a detailed trading journal recording screenshots, reasoning, emotions and outcomes for every trade.

(Refinement): Use your journal to refine which instruments, times and rules work for you instead of constantly changing indicators.

(Resources vs practice): Educational resources and courses can support your learning, but only deliberate practice plus strong risk management will truly build scalping skill.

Introduction to Scalping for Indian Traders

In the Indian context, scalping is usually performed on Markets like:

Index futures and options on NIFTY and BANK NIFTY

Highly liquid individual stocks on NSE and BSE

USD INR and other permitted INR pairs

Actively traded MCX contracts such as Gold and Crude

This style may suit you if:

You are comfortable watching the screen intensively during market hours

You can follow rules under pressure instead of trading emotionally

You understand that even small slippages and fees can eat into results

If any of these are missing, slower swing trading may be a better starting point.

Modern retail scalpers sit on top of this infrastructure, trying to find small edges despite intense competition from automated players.

How Scalping Works

To understand how scalping works on Indian markets, focus on a few key elements.

Fast Execution is a Must

Whether you scalp, be it NIFTY futures,or MCX Crude, your orders must be sent and filled quickly to avoid slippage. This is because you are already aiming for a small profit, any slippage will cost you your entire profit margin for that trade.

Trade Short Timeframe Charts only

Most scalpers work with one minute, three minute or five minute charts, combined with higher timeframe references such as 15 minute or hourly charts.

Technical based decisions

Scalping is mostly driven by technical analysis, and the majority of traders prefer price action trading. Price action trading includes chart patterns and indicators such as VWAP or moving averages, rather than company fundamentals or macro analysis.

Take a few points or ticks in profit

Scalpers may take dozens of trades across the session, especially around times like opening range, post lunch moves or pre expiry activity.

Low spread and low impact

You will usually focus on products where the bid ask spread is tight and where your size is small relative to market volume.

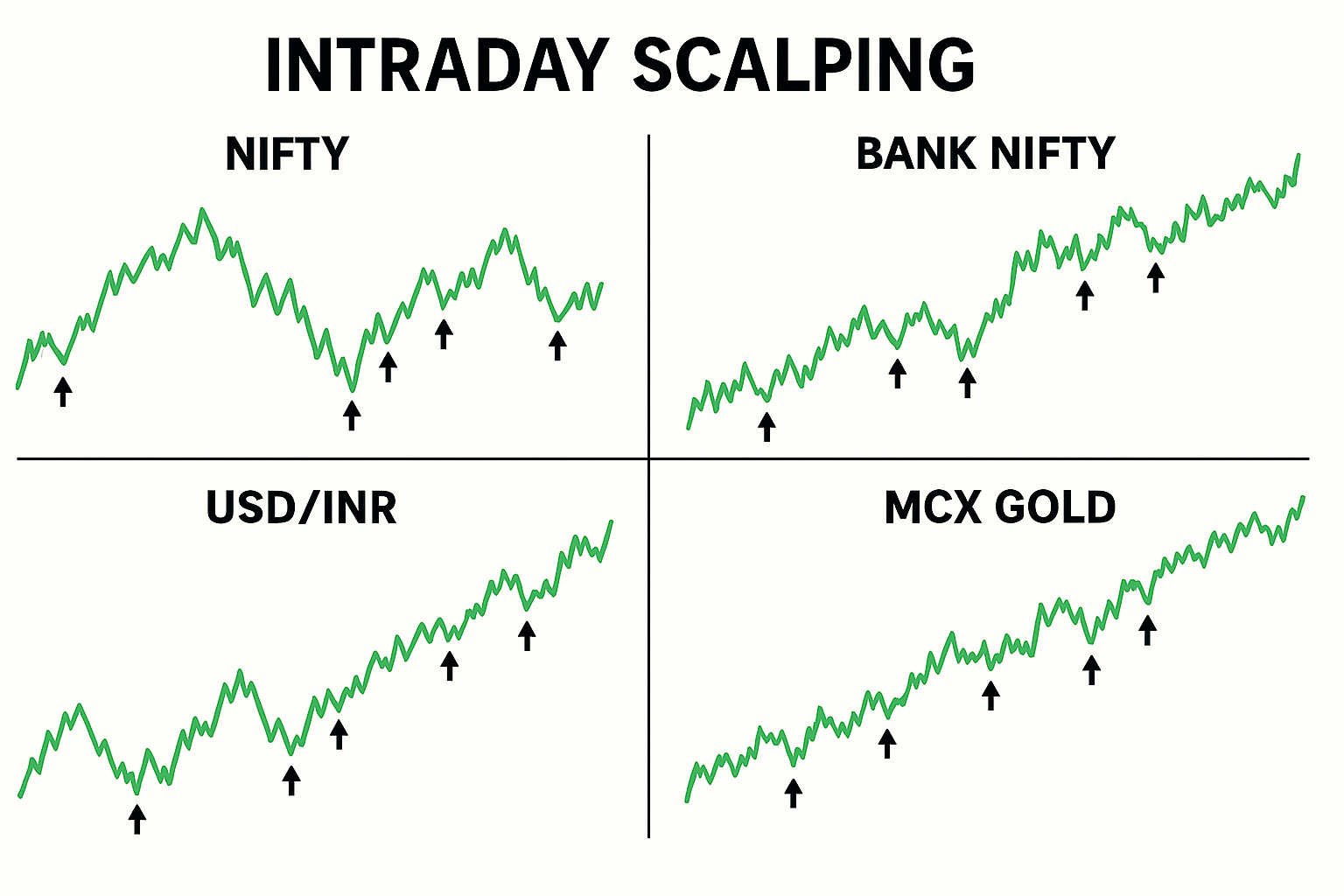

Scalping in Popular Indian Markets

You will see scalping opportunities most often in:

NIFTY and BANK NIFTY futures – Very liquid, tight spreads and strong intraday swings.

USD INR futures and options – Deep volume and clear responses to global data and RBI cues.

MCX Gold and Crude – Good volatility but also gap risk and sharp spikes.

Liquid NSE stocks – Large cap names and index heavyweights that move with the broader market.

Examples:

Quick breakout scalps on NIFTY during the opening 30 minutes.

Short bursts in BANK NIFTY around RBI policy or banking news.

Fast mean reversion trades in MCX Gold when price overshoots Bollinger Bands.

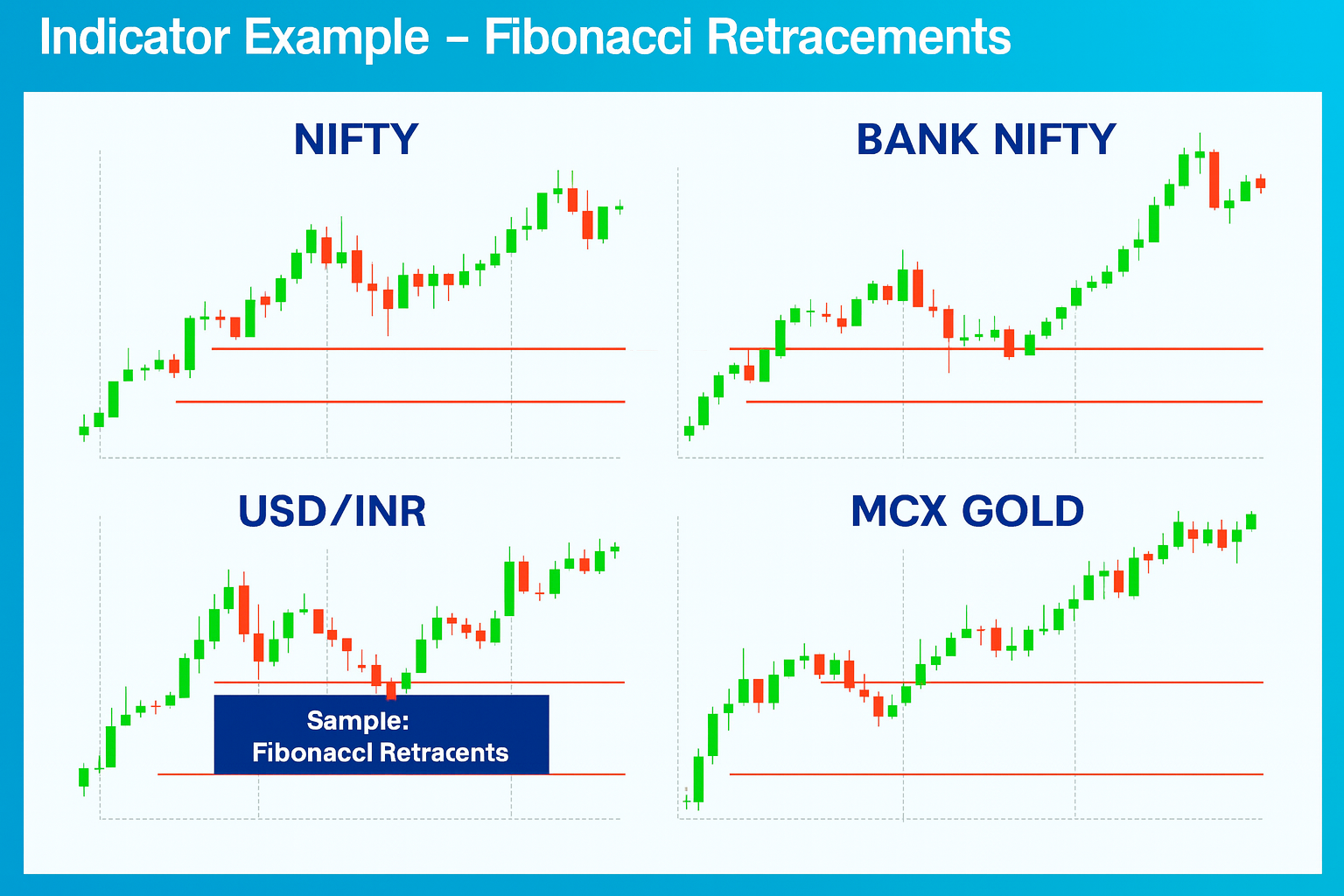

Technical Indicators for Scalping in Indian Markets

Useful tools for Indian scalpers include:

Moving average ribbons

Short and medium term moving averages overlaid together help you see intraday trend direction on NIFTY or MCX charts.

Short period RSI

A 2 or 5 period RSI on a one or three minute chart can highlight quick overbought or oversold conditions suitable for brief mean reversion trades.

Bollinger Bands

Bands help you spot spikes or squeezes during volatile sessions, such as MCX Crude inventory announcements or global risk events impacting NIFTY.

VWAP

Many Indian scalpers watch VWAP as a reference:

Above VWAP: intraday bullish bias

Below VWAP: intraday bearish bias

Market depth (Level 2)

Reading order book depth on NSE, BSE or MCX products helps you anticipate near term liquidity pockets where price may pause.

Regulations and Risk Considerations for Indian Traders

Before applying any scalping strategy with real capital, you must understand a few things:

Is Forex Trading Legal in India?

The main idea is that trading through SEBI regulated brokers and on approved exchanges (NSE, BSE, MCX, etc.) is legal.

Is Forex Trading Halal or Haram?

A common and permissible approach is to use a swap-free or Islamic account with a broker, engage in spot trading with immediate exchange, and base decisions on informed analysis rather than gambling.

Is Scalping Halal or Haram?

Scalping trading's permissibility (halal/haram) in Islam depends heavily on its execution, primarily avoiding interest (riba), gambling (maisir), and excessive uncertainty (gharar). It's considered more permissible if it involves spot trading of halal assets, involves real ownership (even briefly), uses Islamic accounts (no overnight interest/fees), and avoids prohibited activities like short-selling or excessive leverage that resemble gambling

Is Scalping Legal in India?

Yes, scalping trading is completely legal in India, as long as it's done through SEBI-registered brokers, on official exchanges (NSE/BSE), and

complies with regulations like order-to-trade ratios and tax laws, avoiding illegal activities like dabba trading or artificial price inflation. It's a high-risk,

intraday strategy popular for frequent small profits, requiring discipline, analysis, and proper risk management.

Recognise that leveraged derivatives, including intraday index and commodity products, carry a high risk of rapid losses.

Make sure that any access you have to international products or CFD style instruments is legally permitted for you as an Indian resident.

Material such as this guide is educational and does not constitute investment, legal or tax advice. Always consider your financial situation, objectives and risk tolerance, and consult independent professionals where needed.

Tools and Requirements for Successful Scalping in India

Necessary Trading Tools & Infrastructure

If you plan to scalp Indian markets, your setup should include:

A stable, low latency internet connection during market hours.

A capable computer with enough power to run multiple charts and a trading platform smoothly.

A platform that supports fast order entry, custom hotkeys and bracket orders.

Access to reliable real time data for NSE, BSE, MCX and currency segments you trade.

Many serious scalpers also add:

Two or more monitors to track NIFTY, BANK NIFTY and key global cues in parallel.

UPS or backup options in case of power or connectivity issues.

Broker selection for Indian scalpers

When you choose a broker as an Indian scalper, focus on:

SEBI registration and exchange membership for the segments you want to trade (equity, F&O, currency, commodities).

Low brokerage and charges relative to your trading frequency.

Fast, stable order routing to NSE, BSE or MCX.

Clear policies on scalping, intraday trading and high frequency usage of the platform.

You must ensure your trading is done through properly regulated channels. For access to international products like global indices or forex or even CFDs, it is important to understand how such products are regulated, what is permitted for Indian residents and whether cross border activity complies with SEBI and RBI rules.

Educational platforms such as TMGM can be used to study and practise scalping concepts on global markets in a demo environment, before you decide what is appropriate within your own regulatory framework.

Step by Step guide to Scalping in India

In practice, a scalping session for an Indian trader might look like this:

Pre market preparation

Mark key levels on BSE or SIEMENS or any other chosen stocks.

Read up on recent important events such as RBI policy change, global data or corporate results.

Opening range observation

Watch the first 15 to 30 minutes for range, volatility and direction.

Avoid jumping into random moves without a defined plan.

Setup selection

Focus on one or two clear scalping setups (for example, VWAP pullbacks or range breakouts). Don’t over-complicate setups.

Execution with tight risk

Enter with predefined stop loss and target profit levels.

Always respect your stops even if you think the market will come back.

Session management

Pause after a few lost trades or after hitting your pre-set daily loss limit.

Always avoid revenge trading or doubling size to “win it back”.

Post market review

Review screenshots or logs of your trades.

Look for your own behavioural patterns in execution, timing and emotional decisions and see how you can improve.

What are some Top Scalping Strategies?

Successful scalping requires strict risk management, quick decision-making, disciplined execution, and a high-speed trading platform.

Key strategies include using technical indicators like Bollinger Bands, RSI, or moving averages, trading high-liquidity instruments during high-volume hours, and focusing on support/resistance levels and breakouts.

You can read more about Scalping Trading Strategy here.

Risk Management in Scalping

Because scalpers take many trades, risk per trade must be very small relative to total capital.

Key rules:

Risk only a small fixed percentage of your account on each trade.

Place your stop loss the moment you enter. Do not widen it.

Aim for realistic profit targets relative to spread and volatility.

Use a hard daily loss limit. Once reached, you stop trading for the day.

Avoid taking multiple positions in highly correlated instruments (for example, NIFTY, BANK NIFTY and several bank stocks at once).

Consistently profitable scalpers typically focus on steady growth with tightly controlled drawdowns rather than searching for home run trades.

Common Mistakes Indian Traders Make with Scalping

Some frequent issues seen among Indian scalpers include:

Starting on one minute charts without higher timeframe context on NIFTY or BANK NIFTY.

Ignoring costs such as brokerage, taxes and other charges that matter a lot for high frequency styles.

Overtrading during low liquidity periods, such as just before closing or during dead mid session zones.

Trading through major events (RBI policy, Budget, big results) with tight stops, leading to slippage and whipsaws.

Revenge trading after a few losses, doubling position size to recover quickly.

Neglecting risk management because each trade “only” aims for a few points.

Avoiding these behaviours is often more powerful than adding another indicator.

Common Misconceptions About Scalping

Popular myths around scalping in India include:

“It is easier than swing trading” – In reality, you need sharper execution and emotional control.

“More volatility is always good” – Wide swings may create gaps and unpredictable slippage.

“Scalping is always allowed” – You must always respect your broker’s and exchange’s rules and restrictions.

“Tiny stops are safe” – Stops that are too tight may get triggered by normal noise.

Learning Scalping: A Roadmap for Beginners in India

If you want to explore scalping trading as an Indian trader:

Master the basics of Indian markets

Learn how NSE, BSE, MCX and currency derivatives work, along with lot sizes, margins and costs.Study your trading platform

Practise fast order entry, bracket orders and hotkeys on a demo environment before trading live.Backtest and replay

Use historical NIFTY, BANK NIFTY and USD INR charts to test your scalping rules bar by bar.Demo trade intensively

Spend at least a few weeks practising your scalping plan in a demo or virtual environment, focusing on discipline.Start very small live

When you go live, keep your position size and risk minimal until you have a statistically meaningful sample of trades.Maintain a detailed trading journal

Log each scalping trade, including screenshot, reasoning, emotions and outcome.Adjust and refine

Use your journal to refine rules, time windows and instruments, rather than constantly changing indicators.

Educational resources, including articles, trading simulators and specialised courses, can supplement your learning, but no course can replace actual deliberate practice and risk management.